Embarking on the journey to secure auto insurance can sometimes feel like traversing a minefield full of hidden pitfalls and unexpected obstacles. Since there’s an ever-growing list of providers, an overwhelming variety of coverage options, and a wide spectrum of prices, it's no surprise that missteps are common. However, with the right knowledge, you'll be able to sidestep these potential blunders.

We're here to spotlight the top ten mistakes to avoid when choosing auto insurance. Whether you're a driver just starting, someone wrestling with a less-than-perfect driving record, or a seasoned motorist aiming to slash your rates, we can offer invaluable insights. So prepare yourself for an enlightening journey toward securing the ideal auto insurance coverage, avoiding common errors along the way.

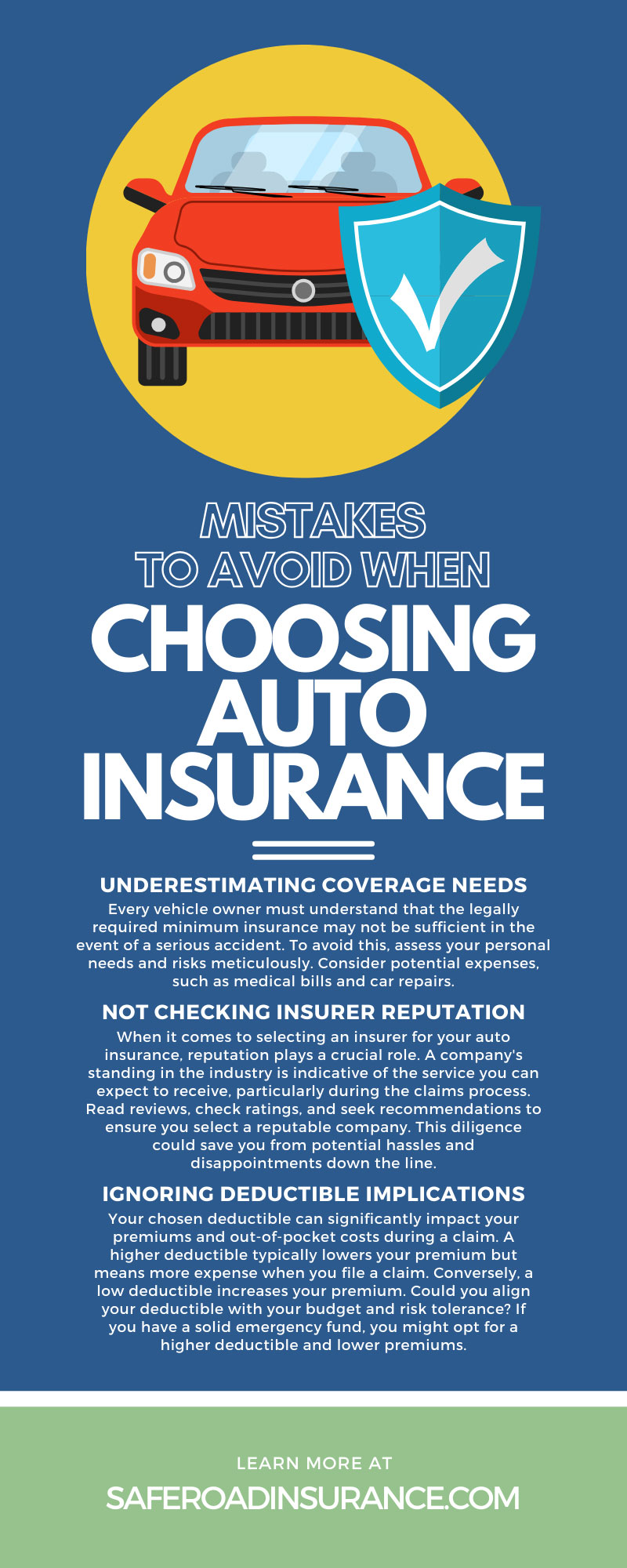

Mistake 1: Underestimating Coverage Needs

Every vehicle owner must understand that the legally required minimum insurance may not be sufficient in the event of a serious accident. To avoid this, assess your personal needs and risks meticulously. Consider potential expenses, such as medical bills and car repairs.

For example, a family previously satisfied with minimum liability encountered significant out-of-pocket expenses following an at-fault accident because their coverage was inadequate. Ensure your policy's ceilings are high enough to protect your assets and savings.

Quick Tip:

Think about supplemental coverages like collision or comprehensive packages to shield against a wide array of possible damages.

Mistake 2: Not Checking Insurer Reputation

When it comes to selecting an insurer for your auto insurance, reputation plays a crucial role. A company's standing in the industry is indicative of the service you can expect to receive, particularly during the claims process. Read reviews, check ratings, and seek recommendations to ensure you select a reputable company. This diligence could save you from potential hassles and disappointments down the line.

Mistake 3: Ignoring Deductible Implications

Your chosen deductible can significantly impact your premiums and out-of-pocket costs during a claim. A higher deductible typically lowers your premium but means more expense when you file a claim. Conversely, a low deductible increases your premium. Could you align your deductible with your budget and risk tolerance? If you have a solid emergency fund, you might opt for a higher deductible and lower premiums.

Mistake 4: Overlooking Policy Exclusions

Every policy has exclusions and limits that define its scope. Review your policy to ensure the circumstances you need coverage for are clear. For example, if you frequently rent cars or require roadside assistance, make sure you have coverage for these scenarios.

Mistake 5: Not Comparing Quotes

It's tempting to grab the first offer, but comparison shopping can yield better coverage terms and pricing. Obtain and evaluate quotes from various providers, looking beyond the price to the value of the coverage provided. Use online quote comparison tools, and don't hesitate to ask insurance agents to match or beat competitive offers.

Mistake 6: Neglecting Discounts

Many insurers offer a plethora of discounts that can meaningfully reduce your premium. Be proactive in identifying any discounts you qualify for, such as safe driver rewards or discounted rates for bundling policies. Keep abreast of new offers and changes in your circumstances that might open additional discount opportunities.

Quick Tip

Other possible discounts could include multicar discounts, good student discounts, or even discounts for certain occupations. However, it's essential to ask questions and make sure you're getting all the discounts you're eligible for. This proactive approach not only demonstrates your insurer's customer service quality but can also lead to substantial savings on your auto insurance premiums.

Mistake 7: Failing To Understand Policy Terms

Confusion about your policy's terms can lead to unpleasant surprises when you need to file a claim. You can familiarize yourself with the terminology and clauses in your policy document. Don't hesitate to ask your insurance agent for clarification on anything that isn't crystal clear. This will empower you to know exactly what's covered and what isn't.

Mistake 8: Forgetting To Update Policy

Changes in your life can affect your insurance needs, and failing to update your policy can leave you vulnerable. Regularly let your insurer know about changes, such as a new vehicle, a move, or modifications to your driving habits. This ensures your policy evolves with your life, preventing you from overpaying or encountering uncovered claims.

Mistake 9: Disregarding Customer Service

The level of customer service an insurer provides can make a significant difference, particularly when you’re dealing with claims. Consider the insurer's reputation for customer support. Make sure to search for an insurer known for being supportive and accessible to their clientele. If you have trouble finding a reputable insurer on your own, ask friends and family to help!

Don't Be Afraid To Ask Questions

Insurance policies are often full of industry-specific jargon and complex terms that can be difficult to understand. It's crucial not to shy away from asking your insurer questions about anything that seems unclear. This is not just about gaining a better understanding of your policy; it's also a way to evaluate the insurer's customer service.

The quality of the responses you receive, the timeliness, and the willingness to assist you can reveal a lot about an insurer's customer service. Remember that good customer service is essential to your protection plan.

So don't hesitate to ask questions. It's your right as a policyholder and can make a significant difference when dealing with claims.

Mistake 10: Not Reevaluating Coverage Regularly

Circumstances change, and so should your coverage. Only reassessing your insurance periodically can lead to adequate protection. Conduct an annual policy review, especially after major life events like purchasing a new car or moving. Adjust your coverage to suit your current needs and ensure you're saving money on something other than extra protections.

Save With Saferoad Insurance

Avoiding these common mistakes when shopping for auto insurance can result in not only better coverage but also potential savings. Remember—the cheapest policy isn't always the wisest choice if it doesn't meet your specific needs. With the right approach, you can secure an insurance policy that’ll offer you peace of mind and the support you need precisely when you need it.

If you're looking for affordable car insurance in California tailored to your needs, consider Saferoad Insurance. We specialize in providing a range of options that cater to your unique requirements. Don't navigate this journey alone; let us guide you toward the optimal coverage for you and your vehicle!